Moratorium A Legal Authorization to Debtors to Postpone Payment on EMI Payment on Home Car loans

Moratorium A Legal Authorization to Debtors to Postpone Payment on EMI Payment on Home Car loans

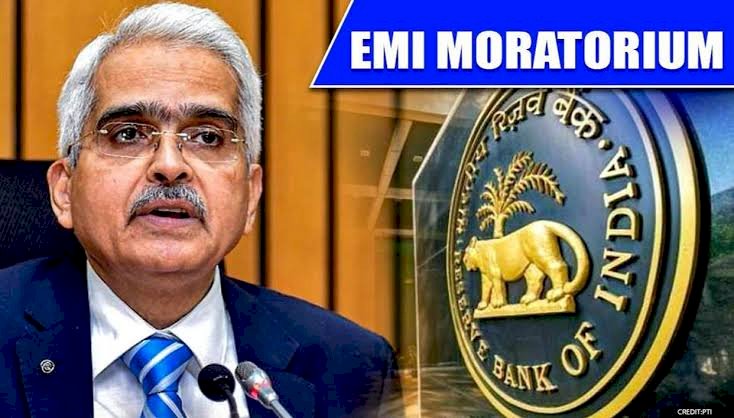

A big releif had been brought in the favour of the citizens of india, by Mr Shaktikanta Das, Governer of Reserve Banks of India as he had announced 75 basis points cut in repo rate, effectively taking the repo rate to 4.4% from the earlier 5.15%. Along with this, RBI has allowed banks and financial institutions to put a Moratorium(A legal authorization to debtors to postpone payment) on term loans. Shaktikanta Das added that the MPC refrained from projecting inflation and growth this time as the situation was too volatile.

The RBI has also announced a comprehensive package, including measures to expand liquidity, steps to reinforce monetary transmission, efforts to ease financial stress by relaxing repayment and endeavour to improve the functioning of the market. “The world is fighting an invisible assassin,” Das said while he announced a slew of measures, including measures to infuse liquidity and a 3-month moratorium on term loans.

The RBI Governor has clarified that the non-payment of EMIs during the moratorium period will not result in asset classification downgrade. Heightened volatility, unprecedented uncertainty and extremely fluid state of affairs, projections of growth and inflation would be heavily contingent on the intensity, spread, and duration of COVID-19, Reserve Bank added.

Definition of 'Repo Rate'

Description: In the event of inflation, central banks increase repo rate as this acts as a disincentive for banks to borrow from the central bank. This ultimately reduces the money supply in the economy and thus helps in arresting inflation.

The central bank takes the contrary position in the event of a fall in inflationary pressures. Repo and reverse repo rates form a part of the liquidity adjustment facility.

What's Your Reaction?