GST Export

GST Export

GST Export

What is export of goods under GST ?

According to section 2 (5) of the IGST act, export of goods with their grammatical forms and cognitive expressions means keeping goods outside India. Export means the trade or supply of goods and services outside the domestic territory of a country.

What is export of service under GST ?

According to Section 2(6) of the IGST Act, Export of services means the supply of any service when-

- The supplier of service is based in India

- The recipient of the service is located outside India

- The place of supply is outside India

- Payment for such service has been received by the supplier of the service in convertible foreign currency or in Indian rupees wherever permitted by the RBI [IGST(Amendment) act 2018)

- The supplier of the service and recipient of the service are not the establishment of only one specific person. If the place of supply is outside India

Place of supply in Nepal or Bhutan, Supply of Services is exempted against payments in Indian rupees, even if payment is received in Indian currency and in view of business practices and trends.

How are Exports treated under GST law?

Under the GST Law, Export of goods and services has been treated as:-

- Inter-state supply (7(5) IGST act) and covered under IGST Act. Export is treated as inter-state supply under GST and IGST is charge on Export.

- Zero rated Supply (section 16(1) IGST Act) Export goods and services will be relived from GST imposed on them at the final product stage.

GST will not levied on any kind of goods or services.

Zero rated supply "means any of the following supplies of goods or services or both, namely: -

(a) export of goods or services or both; or

(b) Supply of goods or services or both for a special economic zone developer or special economic zone

A zero-rated supply does not mean that the tariff rate on goods and services is '0%, but the recipient to whom the supply is made is entitled to pay% 0%' GST to the supplier.

In other words, as discussed in Section 17 (2) of the CGST Act, the input tax credit will not be available in respect of supplies in which the tax rate is% 0%. However, this disqualification does not apply to zero-rated supplies covered by this section.

These provisions of zero rated supply have been introduced into law based on the prevailing central excise and service tax laws. It is widely believed that the introduction of this provision would remove the difficulty of a supplier who exempts goods or services or both in the case of export competition.

This provision also specifically expresses that taxes are not exported. Care must be exercised that when paying taxes, such taxes are not collected from the recipient of goods or services, or both. This will result in unjust enrichment.

Exporters may use such credit for discharge of other production taxes or alternatively, the exporter may claim refund of such taxes, which have been made under CGST or rules of section 54.

A person rated zero rated requires GST registration (in case of service providers, with a turnover less than Rs 20 lakh).

Exporters can claim that GST indemnity cess and indemnity cess will not be refunded on goods exported under bond or LUT (CBE & C Circular No. 1/1/2017 / Compensation Cess dated 26-7-2017).

If GST compensation cess is payable on input but not on the output supply of exported goods, then ITC refund of GST compensation cess can be claimed.

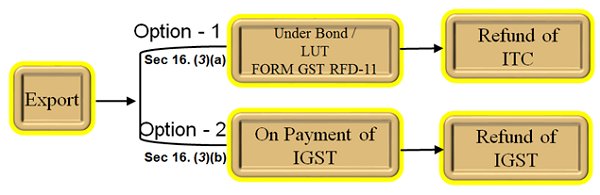

How Exporter can claim refund for Zero rated supply?

A guidance note was issued by the Government of india Which has helped clear doubts about the claim of the input tax credit on zero-rated export. Under GST, an export dealing in zero rated goods can claim refund for zero rated supply as per the following options:-

Option 1. (sec.16 (3)(a)

Step 1 Export

Step2 Under Bond/LUT Form GST RFD-11

Step 3 Refund of ITC

Option 2 . (sec.16 (3)(b)

Step 1 Export

Step 2 on payment of IGST

Step 3 Refund of IGST

The need for bonds has mostly been disputed. Thus all direct exporters are required to execute only LUT w.e.f. 2017/04/10. Now very few cases require bonds and guarantees.

What is the procedure and documentations of Exporting goods?

- Obtains the import and export code (IEC)

- If exporting without paying IGST, furnish a bond or LUT( Letter undertaking)

- Ensure relevant purchase orders are attached to other documents

- Issue tax invoice containing the following details:-

- The supply is export with or without payments of integrated tax

- Name address and GSTIN of supplier

- Invoice number and date

- Name and address of recipient, delivery address and destination of country

- Harmonized System of Nomenclature (HSN) code of goods

- Quantity of goods and number of units

- The total value of goods, breakdown of value into the price per unit

- Signature of authorized signatory of the supplier

- File the shipping bill and include the same details listed on the invoice

- The shipping will can also act as a refund claim provided that :

- The person carrying the export goods files an export manifest;

- Application has filed forms GSTR-3 or GSTR3b appropriately.

What is the procedure and documentations of Exporting service?

As per section 2(6) of the 2017 IGST Act, services qualify as export when:

- Supplier of services are in India

- Recipients of services are situated outside India

- The Place of supply (POS) of services is outside India. For cross-border transactions ,unless specially mentioned , the default POS for services is the location of the recipient of service

- Supplier of such services have received payment for such services in convertible foreign exchange

- Supplier of services and the recipients or services are not merely establishment of distinct person.

- If exports are made without payment of IGST, furnish a bond or LUT

- Ensure that the relevant service agreement is attached to other documents;

- Issue a tax invoice containing the following details:

- Endorsement describing whether the supply is meant for export with or without payment of integrated tax;

- Name, address, and GSTIN of the supplier;

- Invoice number and date;

- Name and address of the recipient;

- HSN Code of services along with a relevant description;

- The total value of services with stage-wise breakdown, if any; and

- Signature of the authorised signatory of the supplier

- To avoid incurring GST charges, maintain documents such as the Foreign Inward Remittance Certificate or Bank Realisation Certificate to act as a proof of receipt of convertible foreign exchange within the prescribed period (typically one year from the date of export). GST will be made applicable to transactions in which exporters do not take this step.

What is mean Deemed Exports?

The supply of goods and services to following would be treated Export under GST

- Supply of goods by a registered person against Advance Authorization

- Supply made to an Export oriented undertaking (EOU) or Hardware Technology Park unit, Software Technology Park unit, Biotechnology Park unit

- Supply of capital goods by a registered person against Export Promotion Capital Goods Authorization

- Supply of gold by a bank or Public Sector Undertaking against Advance Authorization as per Customs law

Filing of returns under GST for the deemed export is to be done as per the general procedures provided for export under GST.

What are the documents required for the claim refund on Exports?

Following documents for claim refund on exports:-

- Copy of invoice

- Copy of return evidence payments

- Any other document required by the government

- Document proving that the burden of paying tax has not been passed on (CA certification or self-certification).

What's Your Reaction?