Compliance under Expatriate Taxation

Introduction

The term ‘Expatriate’ is derived from Latin (ex-Patria) which means “out of the country”.

The Oxford Dictionary defines an expatriate as ‘a person who lives outside their native country’.

Technically an expatriate is a person temporarily or permanently residing in a country and culture other than that of his/her upbringing or legal residence and working abroad on deputation or secondment. For the purpose of easy understanding, it can be said that an expatriate is a resident of a foreign country (for e.g. Japan) working in another country (for e.g. India).

Thus, in the Indian context expatriate means a resident of a foreign country working in India (inbound) or an Indian resident working abroad (outbound) and the taxation of such kind of persons is called “Expatriate Taxation”.

In the next pages, we will deal with the regulatory compliances applicable to Expatriates in terms of VISA requirement, registration requirement, taxation of income earned by the expatriates in accordance with tax treaty and domestic income tax law of India and other related issues dealing with the taxation in India.

Employment Visa (E-Visa)

There are several kind of visa’s like

- Employment Visa,

- Business Visa,

- Tourist Visa,

- Entry (X) Visa,

- Project Visa,

- Student Visa etc.

The person should travel in other countries on the correct visa category depending upon the purpose of his visit. Like if the person would like to visit another country for the purpose of his/her employment in such a country, then he/she should apply and obtain Employment Visa (E-Visa).

An Employment Visa is granted to:-

- An employee or paid intern of an Indian Company;

- Persons traveling to India for volunteer work with Non-Governmental Organization (NGO).

The following categories of foreign nationals are eligible for an Employment Visa:-

- Foreign nationals coming to India as a consultant on contract for whom the Indian company pays a fixed remuneration (this may not be in the form of a monthly salary).

- Foreign artists engaged to conduct regular performances for the duration of the employment contract given by Hotels, Clubs or other organizations.

- Foreign nationals who are coming to India to take up employment as coaches of national/state level teams or reputed sports clubs.

- Foreign sportsmen who are given a contract for a specified period by the Indian Clubs/Organizations.

- Self-employed foreign nationals coming to India for providing engineering, medical, accounting, legal or such other highly skilled services in their capacity as independent consultants provided the provision of such services by foreign nationals is permitted under law.

- Foreign language teachers/interpreters.

- Foreign specialist chefs.

- Foreign engineers/technicians coming to India for installation and commissioning of equipment/machines/tools in terms of the contract for the supply of such equipment/machines/tools.

- Foreign nationals deputed for providing technical support/services, transfer of know-how/services for which the Indian company pays fees/royalty to the foreign company.

- Senior management personnel and/or specialists employed by foreign firms who are relocated to India to work on a specific project/management assignments.

- Foreign nationals coming to India for the execution of a project/contract [irrespective of the duration of the visit].

- Foreign nationals who are coming to India on short visits to a customer location to repair any plant or machinery as part of a warranty or annual maintenance contracts.

- Foreign nationals coming to India for imparting training for the personnel of the Indian company.

An Employment Visa is granted subject to fulfillment of the following conditions:

- The applicant should be a highly skilled and/or qualified professional being engaged or appointed by a company or organization or industry or undertaking in India on the contract or an employment basis at a senior level, skilled position such as technical expert, senior executive, or in a managerial position, etc

- There should not be a qualified Indian available to do the job that the visa holder would be performing. The Employment visa can not be granted for routine, ordinary or secretarial/clerical jobs.

- The employment must either be in a company/firm/organization registered in India or in a foreign company/firm/organization engaged for execution of some project in India.

- The employee's salary must be in excess of US$ 25,000 per year. However, these conditions do not apply to (a) Ethnic cooks, (b) Language teachers (other than English language teachers) / translators and (c) Staff working for the concerned Embassy/High Commission in India.

- The foreign national must comply with all legal requirements like payment of tax liabilities etc.

- The documents pertaining to the proposed employment will be thoroughly checked to decide the category of visa that may be issued to the foreigner.

- The name of the sponsoring employer/organization shall be clearly stipulated in the visa sticker.

- A foreign company/organization that does not yet have any Project office/subsidiary / joint venture/branch office in India can not sponsor a foreign national/employee of a foreign company for an Employment Visa. However, if the Indian company/organization has awarded a contract for the execution of a project to a foreign company that does not have any base in India, such a foreign company can sponsor the employee for Employment Visa. There should not be a qualified Indian available to do the job that the visa holder would be performing.

- The Indian company/organization engaging foreign nationals for executing projects/contracts would be responsible for the conduct of the foreign national during their stay in India and also for the departure of such foreign national upon expiry of the visa.

Duration & Validity of E-Visa

The Embassy/Consulate may grant an employment visa, which is valid for a year, irrespective of the duration of the contract. Further extensions of up to 5 years may be obtained from the Ministry of Home Affairs/ Foreigner Regional Registration Office (FRRO) in the concerned State in India.

Registration

Every expatriate visiting India either on a long term (more than 180 days visa) or short term (less than 180 days visa) must follow the rules and regulations of the Indian Foreigners Act. The deciding factor for getting registered or not under the Registration of Foreigners Act, 1939 and the Registration of Foreigners Rules, 1992 is the validity for which the visa has been granted and not the actual duration of the stay of the expatriate.

In case of visa validity period is more than 180 days:

Every expatriate entering into India on a visa valid for a period of more than 180 days is required to get registered with a jurisdictional officer in FRRO within 14 days from the date of arrival in India which is also written on the E-visa. On completion of registration, the FRRO issue the registration certificate which is called “Residential Permit”. The registration is required only once during the validity of a visa irrespective of the number of times the expatriate leaves/re-enters India on a multiple-entry visa. But, if the person enters India on a new visa, the whole registration process will be followed again.

In case of visa validity period is less than 180 days:

Under this category, the expatriates are not required to register with any jurisdictional officer or obtain Residential Permit. In such cases, Visa has no endorsement to obtain registration with FRRO

Provisions of the Tax Treaty between India and Japan contd…

In order to examine the taxability of income earned from Employment services that in which country it would be taxable, firstly the provisions of the Tax Treaty needs to be checked.

Article 15 (Dependent Personal Services) of the Tax Treaty between India and Japan deals with the taxability of “Remuneration” income earned against employment services.

The provisions of this Article is as under:

Situation – 1 – Taxability in Source Country

Remuneration derived by

- a resident of a Contracting State (Japan)

- in respect of an employment

- shall be taxable only in that Contracting State (Japan)

- unless the employment is exercised in the other Contracting State (India)

If the employment is so exercised, such remuneration as is derived therefrom may be taxed in that other State (India).

Situation – 2 – Taxability could be in Home Country

Notwithstanding the provisions stated in Situation-1, Remuneration derived by a resident of a Contracting State (Japan) in respect of an employment exercised in the other Contracting State (India) shall be taxable only in the first-mentioned Contracting State (Japan), if :

(a)the recipient is present in the other State (India) for a period or periods not exceeding in the aggregate 183 days in the relevant taxable year; and

(b)the remuneration is paid by, or on behalf of, an employer who is not a resident of the other State (India); and

(c)the remuneration is not borne by a permanent establishment or a fixed base or a trade or business which the employer has in the other State (India).

Conclusion:

- An Expatriate stationed in India for the period 183 days or less than 183 days in one Financial Year is not liable to pay income taxes in India. This position is applicable whether the expatriate is working as an employee of a Foreign Company or whether the expatriate is working in an independent capacity. This is however subject to the condition that the salary is being paid by the employer who is not a Resident in India and salary expenses are not born by any Permanent Establishment in India.

- In case an Expatriate is deputed in India by the Foreign Company and such Expatriate is stationed in India for a period exceeding 183 days in a one Financial Year then such Expatriate is liable to pay the income tax due on the salary income in India for the particular financial year as this salary is being paid in lieu of rendering services in India and accordingly income taxes due on salary income has to be deposited to Government treasury.

Provisions of Indian Income Tax Act, 1961 (‘Act’)

Once it is ascertained that the income earned is taxable in India, then we have to see the provisions of the domestic tax law of India i.e. Income Tax Act, 1961.

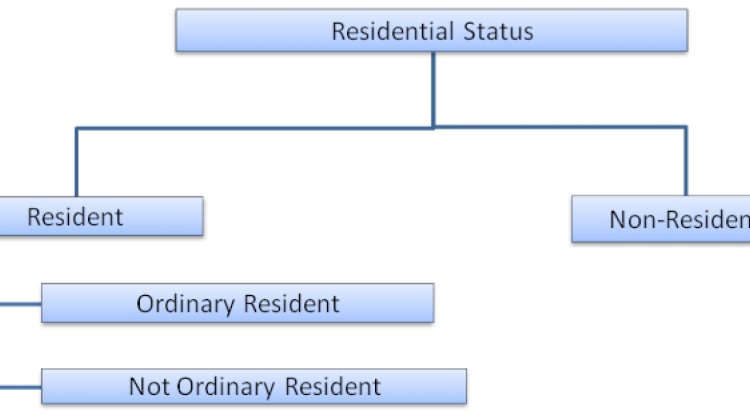

Section 6 of the Act deals with “Residential Status”

The income of Expatriates shall be chargeable to tax in India on the basis of two factors: Their Residential Status in India; and

Nature of Income whether accrued and arise in India or outside India.

The residential status of an individual is determined according to the number of days an individual is present in India in a fiscal year and further divided into two categories i.e. Resident or Non-Resident. The Resident category is further divided into two i.e. Resident & Ordinarily Resident and Resident but not Ordinarily Resident. The rule of residency has been summarized diagrammatically as under:

Basic Conditions to determine the residential status of the Expatriate stationed in India as to when such expatriate is treated as “Resident”

(a) He is in India in the previous year i.e. the relevant year for a period of 120 days or more

OR

(b) He is in India for a period of 60 days or more during the previous year and 365 days or more during 4 years immediately preceding the relevant previous year.

Additional Conditions to determine as to when a Resident is treated as “Ordinarily Resident”

- He has been resident in India in at least 3 out of 10 previous years (according to the aforesaid Basic Conditions) immediately preceding the relevant previous year AND

- He has been in India for a period of 730 days or more during 7 years immediately preceding relevant previous year (as per finance bill 2020)

Summary – Rule of Residence

- Resident but Not Ordinarily Resident - Must satisfy at least one of the Basic Conditions and one or none of the Additional Conditions (i.e. one of (a) or (b) and one or none of (i) or (ii) stated above).

- Resident and Ordinarily Resident - Must satisfy at least one of the Basic Conditions and the two Additional Conditions (i.e. one of (a) or (b) and (i) stated above).

- Non-Resident - Should not satisfy any of the Basic Conditions stated above.

Section 5 of the Act deals with “Scope of total income” as per Residential Status

- In case of Resident but not Ordinarily Resident, an expatriate will be liable to pay Income tax on income which is received/accrued/deemed to accrue or arise in India (“Indian Income”) and all income earned outside India if the same is derived from the business connection in India or a profession which is set up in India.

- In such cases the salary income received is taxable in India irrespective of the fact whether such salary is paid in India or overseas as it falls within the ambit of “Indian Income” as it is received for the services rendered in India.

- In the case of Resident & Ordinarily Resident, an expatriate is also liable to pay income tax on his “Foreign Income” together with “Indian Income”.

In such cases, salary income received by such an Expatriate is taxable in India irrespective of the fact whether such salary is being paid in India or Overseas as it falls within the ambit of “Indian Income”.Also, such an expatriate is liable to pay income taxes in India on the “Foreign Income”. The credit of income taxes if any paid overseas can however be claimed in India subject to the conditions prescribed in Double Taxation Avoidance Agreement (DTAA) between India and Japan.

- In the case of Non-Resident, an Expatriate is liable to pay tax on all income earned in India. He would be exempt from tax in respect of any foreign source income not linked to his employment in India.

Types of income under the head “Salary”

Taxability of income and fringe benefits generally provided to the Expatriates in India

All types of monetary or non-monetary remuneration received or receivable by an employee from the employer for services rendered in India are subject to tax in India like

- Monetary remuneration – Salary, Allowances, Bonus, Leave Encashment, etc.;

- Non-monetary remuneration – Benefits/Amenities (also called ‘Perquisites’) provided by the employer to the employee, Any obligation of employee paid by the employer, etc.

An illustrative list of Non-monetary remuneration provided by the employer to employee is as under:

- Rent Free Furnished / Unfurnished Accommodation;

- Assets provided for the personal use of employee like Refrigerator, Furniture & Fixtures, etc.;

- Motor Car along with Chauffeur for partly official and partly personal use;

- Motor Car along with Chauffeur for fully personal use;

- Payment of utility bills (like electricity, water, power back-up, society maintenance charges, etc.) for the residential accommodation of employee;

- Payment of salary of the security guard, cook, gardener, etc.;

- Contribution to social security funds paid by the employer on behalf of the employee;

- Any other benefits/amenities provided by the employer to the employee; and

- Any other obligation of the employee discharged by the employer.

Statutory Compliances for Employer & Employee

Following Statutory Compliances needs to be complied by both “Employer” & “Employee” (i.e. Expatriate):

For Employer

- To apply for Tax Deduction Account Number (TAN) in Form - 49B & Permanent Account Number (PAN) in Form – 49AA;

- To determine the Residential Status of the Expatriate;

- To calculate the average monthly income tax liability and deposit income tax liability (Withholding Tax) in Challan no. 281 on a monthly basis within the prescribed time limits;

- To file Quarterly Withholding Tax Return (Form 27A and 24Q) within the prescribed time limits;

- To issue a Certificate of Withholding Tax (Form 16 and 12BA) to Employees on an annual basis.

For Employee

- To apply and obtain personal Permanent Account Number (PAN) in Form – 49AA;

- To get registered with Foreign Regional Registration Officer and collect “Residential Permit”; To file Annual Personal Income Tax Return by on or before July 31 following a financial year;

- To apply and obtain “No Objection Certificate” with the Income Tax Department at the time of leaving India for good;

- To surrender “Residential Permit” with the jurisdictional Registration Officer at the time of leaving India for good.

Filing of Personal Income Tax Return with Income Tax Authorities

Section 139 of the Income Tax Act, 1961 deals with filing of “Return of Income”

In case of an individual, filing of return of income [or Income Tax Return (ITR)] in India on annual basis on or before the due date (generally 31st July of next year) is mandatory, if his / her taxable income during the relevant financial year exceeds the maximum exemption limit.

However, in case any individual having a residential status of “Resident & Ordinarily Resident (ROR)” having

Any asset (including financial interest in any entity) located outside India and earned the income during the financial year from such aforesaid assets, OR,

Signing authority in any account located outside India;

He/she is required to file the ITR in the prescribed form compulsorily, whether his / her income is less than the maximum exemption limit or not.

Reporting of Foreign Assets held by Ordinarily Residents (ROR)

This information is to be submitted by only those persons whose residential status is of “ROR" during the Financial Year of which income tax return is to be filed.

In case of an individual who is in India, a Foreign Asset acquired by him during any previous year in which he was non-resident (i.e. other than RNOR or ROR) in India is not mandatorily required to report the details of such foreign assets in the return of income (or income tax return) if no income is derived from that foreign asset during the Financial Year of which income tax return is to be filed.

Thus, only those Foreign Assets details need to be disclosed in the return of income:

-which are acquired when he/she was non-resident in India and earned/received any income from such asset during the Financial Year of which income tax return is to be filed, AND

-which are acquired when he/she was a resident (RNOR & ROR) in India irrespective of the income earned from such asset or not during the Financial Year of which income tax return is to be filed.

RNOR stands for "Resident but not Ordinarily Resident" and ROR stands for "Resident and Ordinarily Resident".

Consequences of failure to disclose Foreign Assets in ITR

The possible consequences of failure to disclose correct particulars of “Foreign Assets” held by Ordinary Residents in the income tax return are as under:

- The income tax return may be treated as ‘Invalid Return’;

- The Revenue Authorities may attempt to take up such income tax return (filed without such disclosures) for scrutiny assessment proceedings;

- The Income Tax Assessment for past 16 years can be re-opened and re-assessed by the Income Tax Department if any income in relation to any asset located outside India (i.e. Foreign Assets) has escaped from the Assessment;(As per Finance Act, 2012, the time limit for reopening the Income Tax Assessment in India is extended to 16 years from 6 years where any income in relation to any asset (including financial interest in any entity) located outside India has escaped from the assessment)

- In case, Revenue Authorities find any income from such foreign assets which was not disclosed in the Income Tax Return, the penalty may be levied along with the tax and interest payable on such under-reported income.

Service Offerings

We can provide the following kind of services under Expatriate Taxation:

- Drafting of Secondment / Dispatch Agreement between Foreign Company and Indian Employer;

- Drafting of Employment Agreement between Expatriate and Indian Employer;

- Obtaining Permanent Account Number (PAN) and Aadhaar Card of Expatriate on arrival into India;

- Registration of Expatriate with Foreigner Regional Registration Office (FRRO) on arrival into India;

- Determining the Residential Status of Expatriate for each year of his/her service in India;

- Computation of taxable income and calculation of average monthly income tax amount to be withheld from salary payments for deposit with Government Treasury;

- Preparation of tax challan and submit with a bank for deposit of withholding tax;

- Co-ordination with Expatriate for the compilation of information of global income and foreign assets details for disclosure in income tax return;

- Preparation & filing of withholding tax return for salary payments made by Employer;

- Preparation of Annual Salary Certificate for salary paid and income tax deposited (Form-16 & 12BA) for issuance to Expatriate;

- Preparation and filing of personal income tax return of Expatriate with Income Tax Authorities;

- Preparation and filing of documents for renewal of Visa and Residential Permit from the office of FRRO or Ministry of Home Affairs;

- Handling income tax scrutiny assessment proceedings of Expatriate and liaison with Income Tax Authorities;

- Surrender of residential permit and obtaining Exit Visa from the office of FRRO at the time of departure of expatriate from India for good;

- Obtaining No Objection Certificate from Income Tax Authorities at the time of departure of expatriate from India for good.

What's Your Reaction?