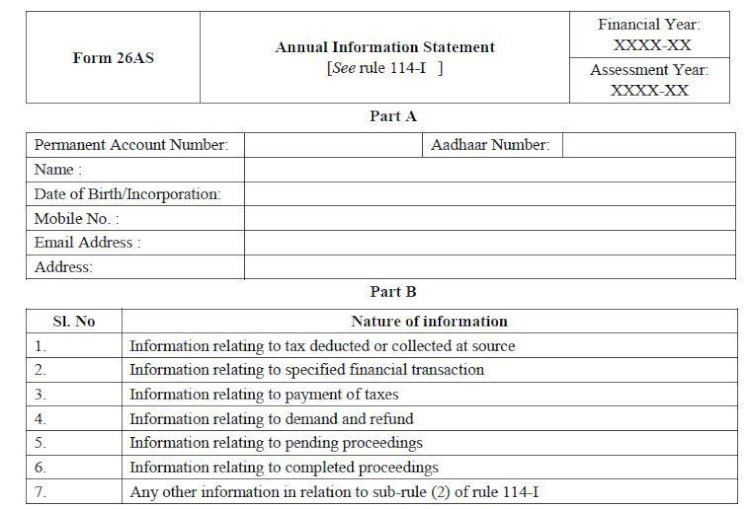

NEW FORM 26AS

Form 26AS is an annual consolidated credit statement issued under Section 203AA of the Income-tax Act, 1961. It can be accessed from the income-tax website by taxpayers using their permanent account number (PAN)

The CBDT notified the revised Form 26AS to vide the Notification 30/2020/F. No. 370142/20/2020-TPL on 28/05/2020 exercising the power conferred by section 285BB read with section 295 of the Income-tax Act, 1961

Date of Effective

- The form comes into force with effect from 1st June 2020.

What are the changes in Form 26AS from 1st June 2020

The major change

- The rule 31AB i.e annual statement of tax deducted and collect or paid is omitted

- As per rule 114H, the following thing is inserted

- which said The Principal Director General of Income-tax (Systems) or the Director-General of Income-tax (Systems) or any person authorized by him

- shall, under section 285BB of the Income-tax Act,1961, upload in the registered account of the assessee an annual information statement

- which is in his possession within three months from the end of the month in which the information is received by him

- In Form No. 26AS containing the information specified in column (2) of the table below,

|

SI. NO. |

Nature of information |

|

(i) |

Information relating to tax deducted or collected at source |

|

(ii) |

Information relating to the specified financial transaction |

|

(iii) |

Information relating to the payment of taxes |

|

(iv) |

Information relating to demand and refund |

|

(v) |

Information relating to pending proceedings |

|

(vi) |

Information relating to completed proceedings |

New Section 285BB introduced vide Finance Act 2020

- Comes into force with effect from the 1st day of June 2020

- A new section 285BB in the Income Tax Act 1961 was introduced regarding the annual financial statement.

- 'Annual Information Statement' which apart from the TDS/ TCS details, shall now contain information related to specified financial transactions, payment of taxes, demand/ refund and pending/completed proceedings undertaken by a taxpayer in a particular financial year that has to be mentioned in the income tax returns.

- It also includes information about financial transactions carried out by the taxpayer.

What's Your Reaction?