Micro, Small and Medium Enterprises (MSME)

MSME

MSME stands for Micro, Small and Medium Enterprises. In a developing country like India, MSME industries are the backbone of the economy.

The MSME sector contributes to 45% of India’s Total Industrial Employment, 50% of India’s Total Exports and 95% of all industrial units of the country and more than 6000 types of products are manufactured in these industries (As per msme.gov.in). When these industries grow, the economy of the country grows as a whole and flourishes. These industries are also known as small-scale industries or SSI’s.

Even if the Company is in the manufacturing line or the service line, registrations for both these areas can be obtained through the MSME act. This registration is not yet made mandatory by the Government but it is beneficial to get one’s business registered under this because it provides a lot of benefits in terms of taxation, setting up the business, credit facilities, loans etc.

The MSME became operational on October 02, 2006. It was established to promote, facilitate and develop the competitiveness of the micro, small and medium enterprises.

What are Micro, Small and Medium Enterprise?

The existing MSME classification was based on the criteria of investment in plant and machinery or equipment. So, to enjoy the MSME benefits, the MSMEs have to limit their investment to a lower limit, as mentioned below:

|

Existing MSME Classification |

||||

|

Sector |

Criteria |

Micro |

Small |

Medium |

|

Manufacturing |

Investment |

< Rs.25 lakh |

< Rs.5 crore |

< Rs.10 crore |

|

Services |

Investment |

< Rs.10 lakh |

< Rs.2 crore |

< Rs.5 crore |

The new limits based on Investment & Annual turnover for both Mannufacturing and Service sector are as follow:

- Any enterprise with investment up to Rs 1 crore and turnover under Rs 5 crore will be classified as “Micro“.

- Any enterprise with investment up to Rs 10 crore and turnover up to Rs 50 crore will be classified as “Small“

- Any enterprise with investment up to Rs 20 crore and turnover under Rs 100 crore will be classified as “Medium“.

Benefits of MSME Registration

- Due to the MSME Registration, the bank loans become cheaper as the interest rate is very low around ~ 1 to 1.5%. Much lower than interest on regular loans.

- It also allowed credit for minimum alternate tax (MAT) to be carried forward for up to 15 years instead of 10 years

- Once registered the cost getting a patent done, or the cost of setting up the industry reduces as many rebates and concessions are available.

- MSME registration helps to acquire government tenders easily as Udyam Registration Portal is integrated with Government e-Marketplace and various other State Government portals which give easy access to their marketplace and e-tenders.

Documents Required

The Udyam registration process is entirely online and does not require the uploading of any documents. However, before applying for Udyam Registration, the proprietor or owner of the enterprise is required to have the following documents:

- Aadhar Card

- In the case of a Proprietorship Firm, the Aadhar number of the proprietor is to be entered in the Udyam Registration form.

- In the case of a Partnership Firm, the Aadhar number of the managing partner is to be entered in the Udyam Registration s

- In the case of a Hindu Undivided Family (HUF), the Aadhar number of the Karta is to be entered in the Udyam Registration form.

- In the case of a Company or Limited Liability Partnership or a Cooperative Society or a Society or a Trust, the Aadhar number of the organisation or authorised signatory is to be entered in the Udyam Registration form.

- PAN Card

The above documents need not be uploaded but the Aadhar and PAN number of the entrepreneur is required to be entered in the registration form.

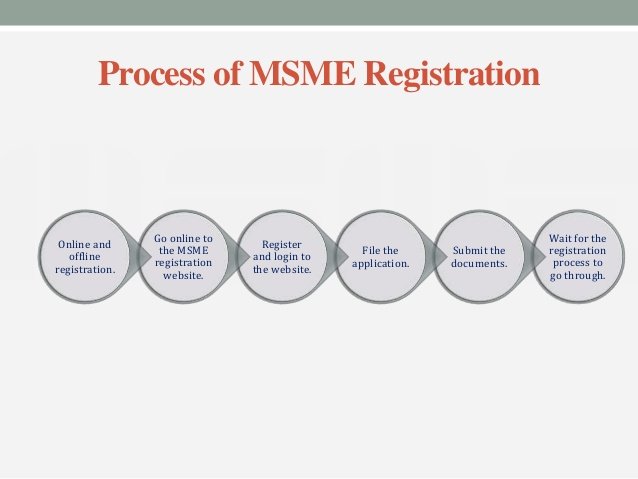

MSME Registration Process

MSME registration is to be done in the government portal of udyamregistration.gov.in. The registration of MSMEs can be done under the following two categories in the portal –

- For New Entrepreneurs who are not Registered yet as MSME and

- For those having registration as EM-II or UAM and For those having registration as EM-II or UAM through Assisted filing

Step by step registration process for MSME

- Start Registration Process

Go to https://www.msmeregistration.org/ to start the MSME Registration Process.

- Fill Application Form

At the first step, you have to fill basic details in MSME Registration form that will include all the necessary details of your business such as company name, registration number, GST number and so on.

- Enter Personal Details

At this stage, you are required to fill in all your personal details such as name, address, PAN Card, bank account details and some common information that is mandatory during the MSME registration process. Also, a photo needs to be uploaded. Ensure that the size of the photo is within the permissible limits for it to be uploaded on the sire.

- Executive Will Process Application

At this process, an MSME executive will review your application. In case of any discrepancy, you will be notified about the process and make the relevant changes.

- Receive Certificate of Mail

After filling the complete form you will get the certificate for MSME Registration. To know how it would be, you can download a copy of the Sample MSME Certificate. The Ministry will not issue you any hardcopy for it. You will get a virtual certificate for MSME Registration.

This is the process for the MSME registration for companies.

What's Your Reaction?