CAPITAL GAINS TAX

Capital Gains Tax

A capital gains tax is a tax on the growth in value of investments incurred when individuals and corporations sell those investments. When the assets are sold, the capital gains are referred to as having been “realized”. The tax doesn't apply to unsold investments or "unrealized capital gains" so stock shares that appreciate every year will not incur capital gains taxes until they are sold, no matter how long you happen to hold them.

Capital gain can be defined as any profit that is received through the sale of a capital asset. The profit that is received falls under the income category. Therefore, a tax needs to be paid on the income that is received. The tax that is paid is called capital gains tax and it can either be long term or short term. The tax that is levied on long term and short term gains starts from 10% and 15%, respectively.

Under the Income Tax Act, capital gains tax in India need not be paid in case the individual inherits the property and there is no sale. However, if the person who has inherited the property decides to sell it, tax will have to be paid on the income that has been generated from the sale. Some of the examples of capital assets are jewellery, machinery, leasehold rights, trademarks, patents, vehicles, house property, building, and land.

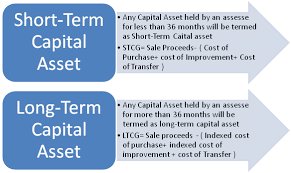

Types of Capital Assets

- The two types of capital assets are mentioned below:

- Long Term Capital Asset:

In case individuals own an asset for a duration of more than 36 months, the asset is a long term capital asset. Debt-oriented mutual funds, jewellery, etc., that are held for a duration of more than 36 months will come under this category and there is no 24-month reduction period under such circumstances.

The below-mentioned assets are considered as long term assets if they are held for a duration of more than 12 months:

- Zero coupon bonds (not dependent on whether they are quoted or not)

- Unit Trust of India (UTI) units (not dependent on whether they are quoted or not)

- Equity-based mutual funds units (not dependent on whether they are quoted or not)

- Securities that are listed on a stock exchange that is recognised in India. Examples of such securities are government securities, bonds, and debentures.

- Preference shares or equities that are held in a company that is listed on a stock exchange that is recognised in India.

- Short Term Capital Asset:

In case assets are held for a duration of 36 months or less, it can be defined as a short term capital asset. However, for immovable assets such as house property, building, and land, the duration has been reduced from 36 months to 24 months.

Therefore, if an individual wishes to sell a land or house after holding it for a duration of 24 months, the profit that the individual makes from it comes under long term capital gain.

In case the property has been inherited or given as a gift, the amount of time the property was held by the previous owner is also considered when determining whether the property can be considered as a short term capital asset or a long term capital asset.

The date on which the bonus shares were allotted is considered when determining the category under which bonus shares or right shares fall.

Tax on Gold

Gold Income Tax in India 2021

- The profits from the sale of gold bars, jewelry, coins, ETF, etc. attract tax under capital gain.

- Long term capital gain is applicable if the gold is sold after 3 years from the date of purchase.

- Short term capital gain is applicable if the gold is sold before 3 years from the date of purchase.

- The long term capital gain is taxed at the rate of 20%, while short term capital gain is taxed as per the applicable tax slab.

- If the gold is received as a gift, then it will be taxed if the value of gold received during the financial year exceeds ₹ 50,000.

- In case of sale of gold received as gift or inheritance, the applicability of long term and short term capital gain is determined based on the combined holding period.

Capital Gain Tax on Gold, Gold Jewelry, Bars, ETF, Gold Coins, Gold utensils

|

Type Of Gain |

Holding Period |

Capital Gain Tax Rate |

Exemption |

|

Short term capital gain on gold |

Less than 3 years |

As per the tax slab applicable to the assesee |

None |

|

Long term capital gain on gold |

More than or equal to 3 years |

20% with indexation benefit |

Exemptions available if the net proceeds are invested in Section 54EC bonds or in residential property section 54F |

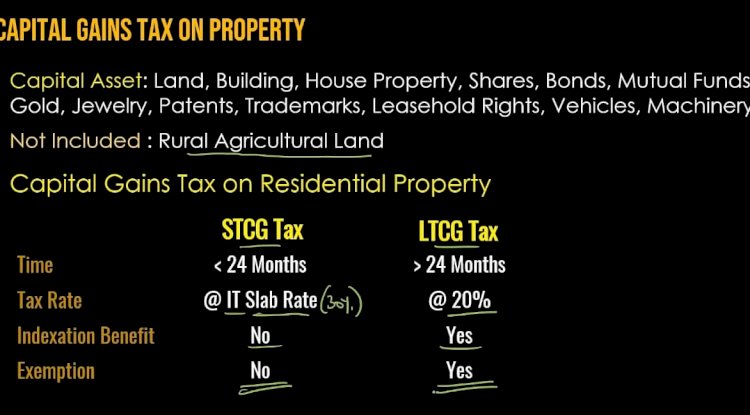

Capital Gain Tax on Property

Capital Gain Tax India

|

Point of Difference |

Long Term Capital Gains Tax on Property |

Short Term Capital Gains Tax on Property |

|

Meaning |

Long term capital gain on the property is applicable when the property is sold after 3 years |

Short Term Capital Gain on the property is considered as a gain from selling a property which was held by you for less than 24 months. |

|

Tax Applicable |

20% |

As per Income Slab Rate |

|

Adjustments |

Benefit on indexation is available on the purchase price of long term capital gains |

Benefit on indexation is not available on the purchase price of short term capital gains |

|

Exemption |

Exemptions on reinvesting the gain in0020residential property or buying bonds issued by RECL or NHAI. |

No exemption or savings is allowed on short term capital gain tax by re-investment in property. |

Property held for 2 years or more to qualify as long term asset

|

Tax Treatment |

Holding Period Criteria FY2017-18 Onwards |

Holding Period Criteria Upto FY2016-17 |

Tax Rate |

|

Short terms capital gains |

Less than 2 years after registry or issue of OC, whichever is later |

Less than 3 years after registry or issue of OC, whichever is later |

Marginal tax rate – (upto 30%), 3% cess and upto 15% surcharge |

|

Long Term Capital Gains |

2 years or more |

3 years or more |

20% with indexation benefit and 10% without indexation ebenfit Exemptions available if proceeds invested in residential house or Section 54EC bonds. Indexation benchmark changed to 2001 from 1981-82 effective 2017-18. |

Income Tax Slab

Income Tax Slab 2020-21

Last Updated 17th Apr 2021

|

Income Range Per Annum |

Tax Rate As Per Old Regime |

Tax Rate As Per New Regime |

|

Upto ₹ 2.50 Lakh |

No Tax |

No tax |

|

₹ 2.50 Lakh – ₹ 5 Lakh |

5% |

5% |

|

₹ 5 Lakh – ₹ 7.50 Lakh |

20% |

10% |

|

₹ 7.50 Lakh – ₹ 10 Lakh |

20% |

15% |

|

₹ 10 Lakh – ₹ 12.50 Lakh |

30% |

20% |

|

₹ 12,50,000 – ₹ 15,00,000 |

30% |

25% |

|

Above ₹ 15,00,000 |

30% |

30% |

- In some cases, when you sell Agricultural Land – it may be entirely exempt from Income Tax or it may not be taxed under the head Capital Gains–

- Agricultural land in Rural Area in India is not considered a capital asset. Therefore any gains from its sale are not taxable under the head Capital Gains. For details on what defines an agricultural land in a rural area, see details of capital assets.

- Do you hold agricultural land as stock-in-trade? If you are into buying and selling land regularly or in the course of your business, in such a case, any gains from its sale are taxable under the head Business & Profession.

- Under Section 10(37) of the Income Tax Act, Capital Gains on compensation received on compulsory acquisition of urban agricultural land is exempt from tax.

- Leasehold Rights can’t be computed as Capital Gains in respect of transactions in land or building under Section 50C

v Assets exempt from capital gains

- Any stock held in trade (profits on this will be taxed as business income).

- Consumable raw materials which are kept for the specific purpose of any business or as per profession (taxed under business income).

- Any personal effects which are movable/effects kept for personal use.

- Agricultural land which is not located within an 8 km radius of any municipality, Municipal Corporation, notified area board, any town committee / cantonment area board having a minimum residential population of 10,000 people.

- National Defense Gold Bonds 6.5 % Gold Bonds or the Special Bearer/ Gold Deposit bonds under the Government Gold Deposit Scheme.

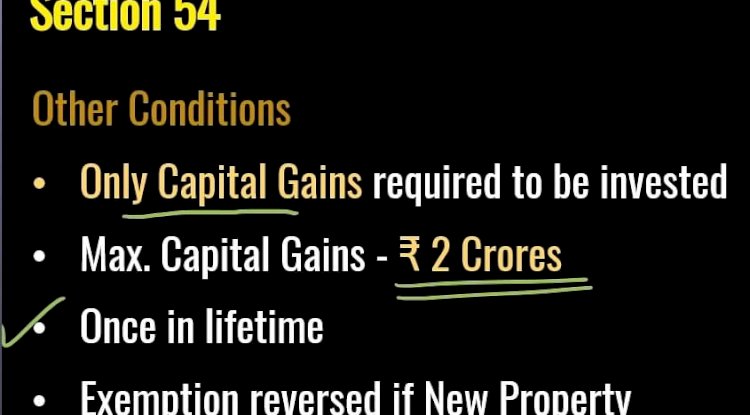

v Capital Gains Tax Exemptions

- These exemptions mentioned below can be claimed either fully or partially. For example if purchase price is Rs 80 lakh and your sale proceeds are Rs 1 crore (hence gains of Rs 20 lakh) and you deposit Rs 50 lakh as per the below mentioned exemptions, half your capital gains (Rs 10 lakh) will be exempt. The other half (Rs 10 lakh) will be taxable.

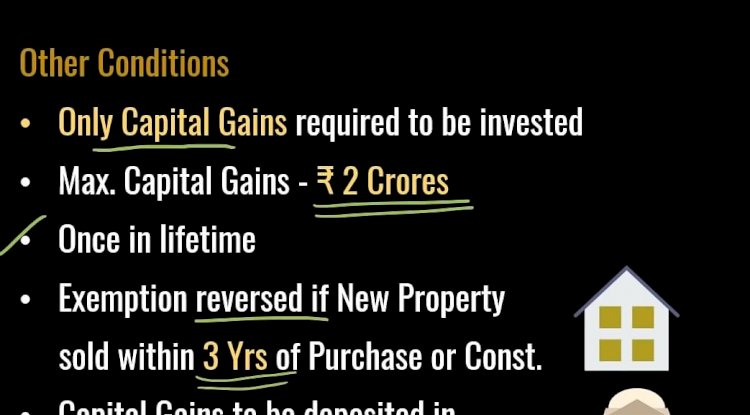

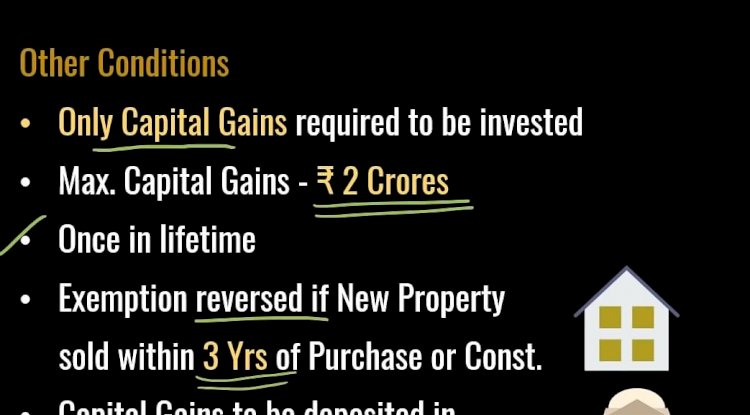

- Section 54: If the sale proceeds of a residential property are further utilized to buy another residential property, the capital gains on the sale proceeds are exempt. This is however subject to the following conditions

a)The purchase of property should be done either 1 year prior to selling the property or within two years of the sale.

- b) In case of under construction property, the same should be done within maximum three years from the transfer date of the earlier property.

c)The newly acquired property cannot be further sold within 3 years of purchase or construction.

- d) The newly acquired property should be located in India.

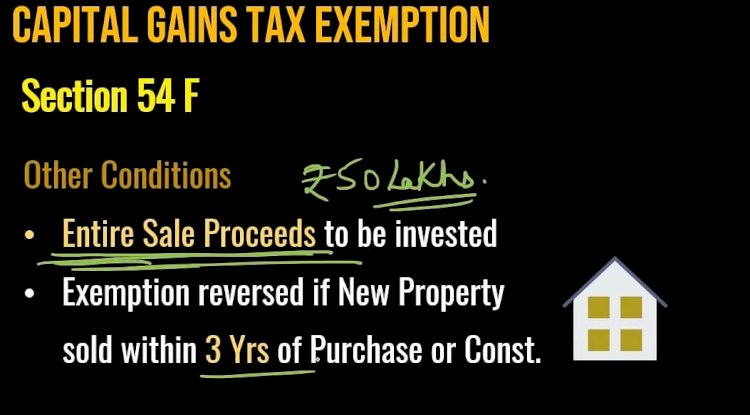

- Section 54F: If you sell any other asset like agricultural land within 10 km of a city or valuable paintings, jewellery, debt funds etc, you can take the benefit of Section 54F. This section grants deduction for purchase of a house property from the proceeds of the sale of any capital asset. The following additional conditions apply:

a)The purchase of property should be done either 1 year prior to selling the property or within two years of the sale.

- b) In case of under construction property, the same should be done within maximum 3 years from the transfer date of the earlier property.

c)The newly acquired property cannot be further sold within 3 years of purchase or construction.

- d) The newly acquired property should be located in India.

- e) The person should not have more than one residential property on the date of the transfer.

- f) No other property is purchased within 1 year of the transfer or constructed within 3 years of the transfer

The investor can deposit the sale proceeds in a Capital Gains Account Scheme before the due date for filing returns in order to take the benefit of the above sections even if he has not bought/constructed another property. However he must buy/construct the new property within the time limits specified above and can pay for it by using the money deposited in the Capital Gains Account Scheme.

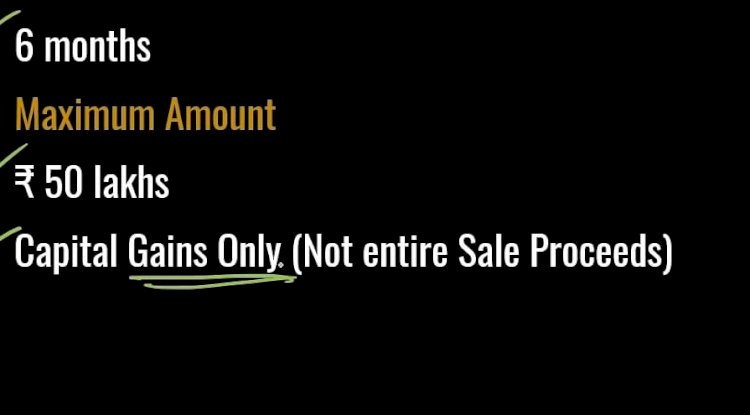

- Section 54EC: Capital Gains Bonds issued by NHAI (National Highways Authority of India) and REC (Rural Electrification Corporation) are eligible for exemption from capital gains tax up to Rs 50 lakh. They have a tenure of 5 years and carry a fixed interest rate (currently 5.25%). The interest on these bonds is taxable. Only capital gains in real estate are eligible for this deduction. For example, if you buy an asset for Rs 10 lakh and sell it for Rs 20 lakh investing the entire Rs 20 lakh in NHAI/REC capital gains bonds, the said transaction would not attract capital gains tax.

- Different assets have different periods of holding to be called short term and long term. Here is a table that defines period of holding for different classes of asset in order to be classified as short term or long term.

|

Asset |

Period of holding |

Short Term / Long Term |

|

Immovable property |

< 24 months |

Short Term |

|

>24 months |

Long Term |

|

|

Listed equity shares |

<12 months |

Short Term |

|

>12 Months |

Long Term |

|

|

Unlisted shares |

<24 months |

Short Term |

|

>24 months |

Long Term |

|

|

Equity Mutual funds |

<12 months |

Short Term |

|

>12 months |

Long Term |

|

|

Debt mutual funds |

<36 months |

Short Term |

|

>36 months |

Long Term |

|

|

Other assets |

<36 months |

Short Term |

|

>36 months |

Long Term |

|

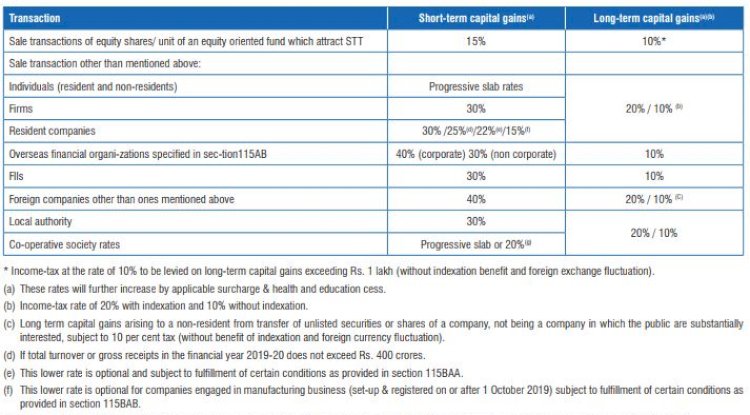

Capital Gains on Shares

Long & Short Term Capital Gain Tax on Shares

- In case of shares, the long term capital gain is levied if the holding period is 1 year or more.

- The short term capital gain tax is charged at the rate of 15%, while long term capital gain is charged at the rate of 10% if the gain is above Rs. 1 lakh.

- For securities other than shares and mutual funds listed on recognized stock exchanges, the long term capital gain tax rate is 10%.

- The short term capital gain tax is charged at a marginal rate of 5% to 30% plus 3% cess, for all securities other than shares and mutual funds listed on recognized stock exchanges.

Capital Gains on Sale of Bonds & Debentures

|

Type of Asset |

Period of Holding |

Capital Gains |

|

Listed Bonds & Debentures |

Less than 12 months |

Short Term Capital Gains |

|

Listed Bonds & Debentures |

More than 12 months |

Long Term Capital Gains |

|

Unlisted Bonds & Debentures |

Less than 36 months |

Short Term Capital Gains |

|

Unlisted Bonds & Debentures |

More than 36 months |

Long Term Capital Gains |

Income Tax on Sale of Bonds & Debentures

|

Type of Asset |

Capital Gains |

Tax Rate |

|

Listed Bonds & Debentures |

Short Term Capital Gains |

Slab Rate |

|

Listed Bonds & Debentures |

Long Term Capital Gains |

10% without Indexation |

|

Unlisted Bonds & Debentures |

Short Term Capital Gains |

Slab Rate |

|

Unlisted Bonds & Debentures |

Long Term Capital Gains |

20% without Indexation |

Income Tax on Other Income from Bonds & Debentures

Interest Income from Bonds & Debentures is taxed as per slab rates. Usually, the interest on bonds is taxable income. However, in the case of tax-free bonds, the interest income is exempt from tax.

An investor who invests in tax-free bonds should calculate the pre-tax yield before making the investment decision. To calculate the pre-tax yield, use this formula – ROI / (100-TR) * 100. (TR means Taxable Rate)

|

Fund type |

Short-term capital gains |

Long-term capital gains |

|

Equity funds |

15% + cess + surcharge |

Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

|

Debt funds |

Taxed at the investor’s income tax slab rate |

20% + cess + surcharge |

|

Hybrid equity-oriented funds |

15% + cess + surcharge |

Up to Rs 1 lakh a year is tax-exempt. Any gains above Rs 1 lakh are taxed at 10% + cess + surcharge |

|

Hybrid debt-oriented funds |

Taxed at the investor’s income tax slab rate |

20% + cess + surcharge |

What's Your Reaction?