Guidelines for Allotment Of Instant PAN through Aadhaar Based e-KYC

Instant PAN allotment Scheme

This facility is for allotment of Instant PAN (on the near-real-time basis) for those applicants who possess a valid Aadhaar number. PAN is issued in PDF format to applicants, which is free of cost.

The applicant is required to type in her/his valid Aadhaar number and submit the OTP generated on the registered mobile number. Once the process is complete, a 15-digit acknowledgment number is generated. Once a request is submitted, the applicant can check the status of the request at any time by providing her/his valid Aadhaar number and on a successful allotment can download the PAN. The applicant will also receive a copy of the PAN in the e-mail id registered with the Aadhaar database.

The salient points of this facility are:

1. The applicant should have a valid Aadhaar which is not linked to any other PAN.

2. The applicant should have his mobile number registered with Aadhaar.

3. This is a paperless process and applicants are not required to submit or upload any documents.

4. The applicant should not have another PAN. Possession of more than one PAN will result in a penalty under section 272B(1) of the Income-tax Act.

How to apply for instant PAN

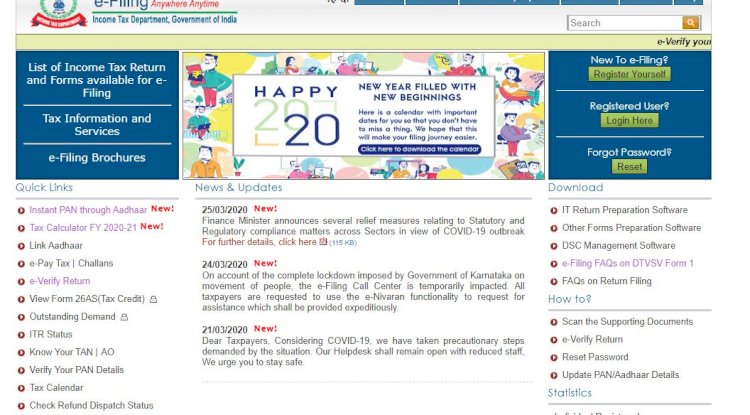

Step 1

To apply For Instant PAN visit at e filing website of Income-tax department(URL: www.incometaxindiaefiling.gov.in)

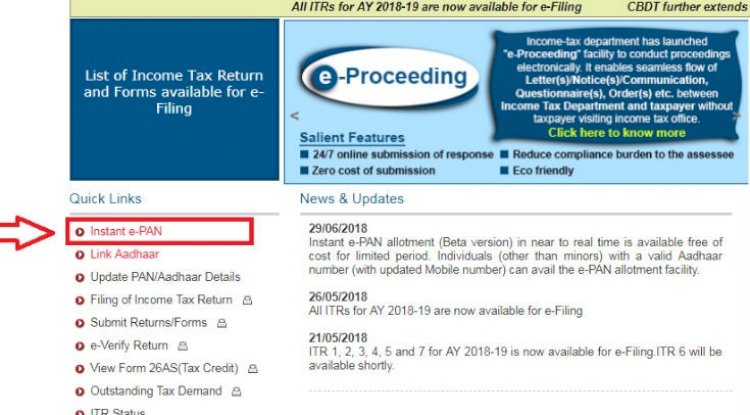

Step 2

Click the link ‘Instant PAN through Aadhaar’ at an e-filing website of the Income-tax Department.

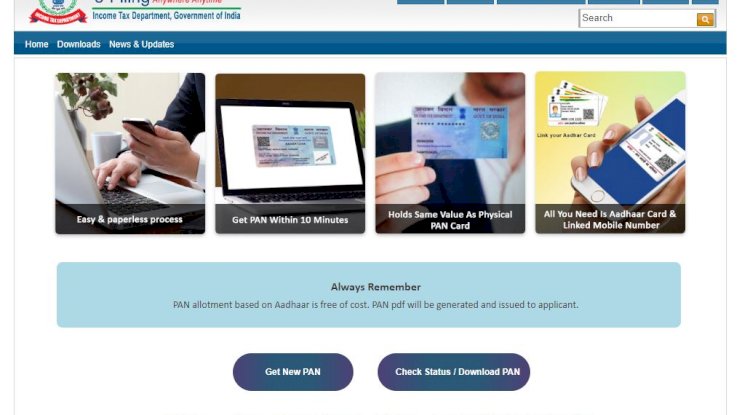

Step 3

Click the link- ‘Get New PAN’ ’at https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/ApplyePANThroughAadhaar.html?lang=eng

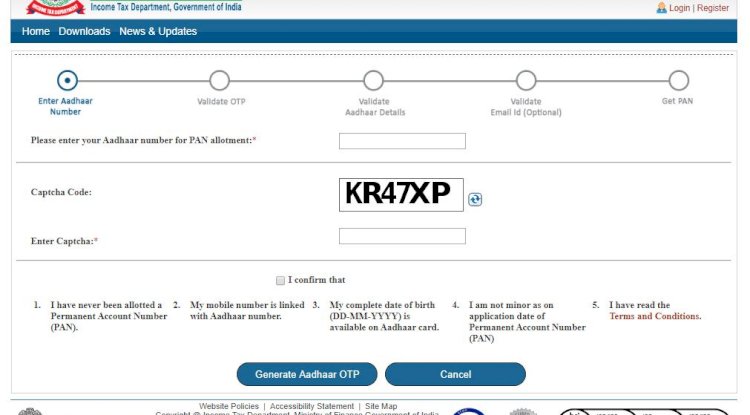

STEP 4

Fill in your Aadhaar in the space provided, enter captcha and confirm.

STEP 5

STEP 5

The applicant will receive an OTP on the registered Aadhaar mobile number; submit this OTP in the text box on the webpage.

After submission, an acknowledgment number will be generated. Please keep this acknowledgment number for future reference.

On successful completion, a message will be sent to the applicant’s registered mobile number and e-mail id (if registered in UIDAI & authenticated by OTP). This message specifies the acknowledgment number.

How to download PAN

1.STEP 1

To download PAN, please go to the e-Filing website of the Income-tax Department.

(Url: www.incometaxindiaefiling.gov.in)

2. STEP 2

Click the link- ‘Instant PAN through Aadhaar’ at https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/ApplyePANThroughAadhaar.html?lang=eng

3. STEP 3

Click the link- ‘Check Status of PAN’at https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/ePANStatus.html?lang=eng

4. STEP 4

Submit the Aadhaar number in the space provided, then submit the OTP sent to the Aadhaar registered mobile number.

5. STEP 5

Check the status of an application- whether PAN is allotted or not.

6. STEP 6

If PAN is allotted, click on the download link to get a copy of the e-PAN pdf

What's Your Reaction?