ALL ABOUT GST INVOICE

1. What is a GST Invoice?

An invoice or a GST bill is a list of goods sent or services provided, along with the amount due for payment.

2. Who should issue GST Invoice?

If you are a GST registered business, you need to provide GST-complaint invoices to your clients for sale of good and/or services.

Your GST registered vendors will provide GST-compliant purchase invoices to you

3. What are the mandatory fields a GST Invoice should have?

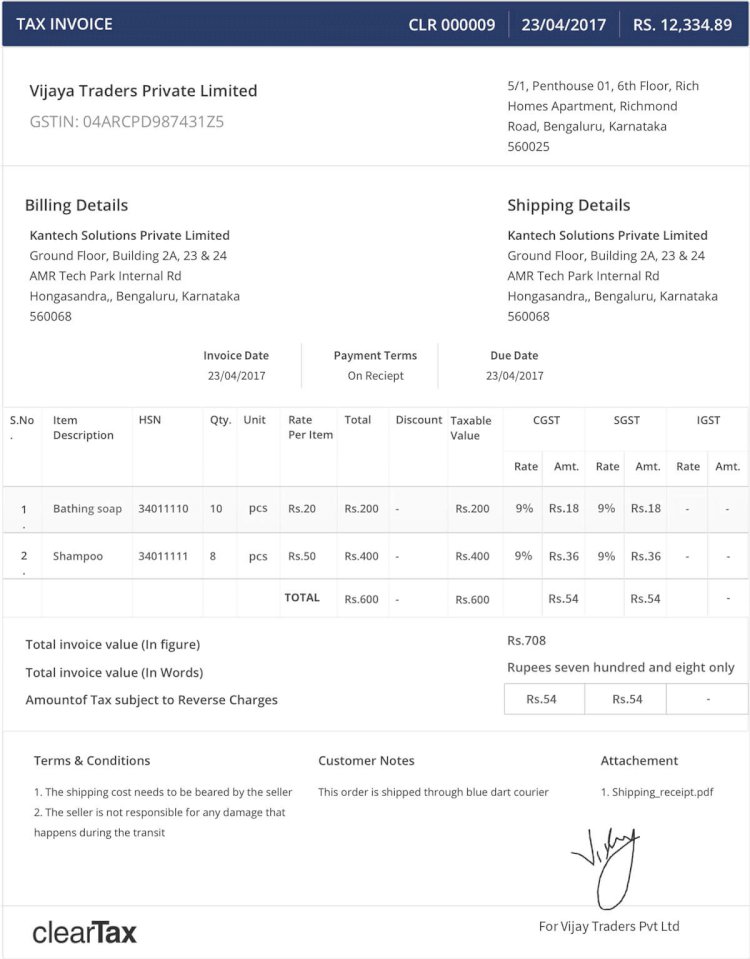

The tax invoice issued must clearly mention information under the following 16 headings:

1. Name, address and GSTIN of the supplier

2. Tax invoice number (it must be generated consecutively and each tax invoice will have a unique number for that financial year)

3. Date of issue

4. If the buyer (recipient) is registered then the name, address and GSTIN of the recipient

5. If the recipient is not registered AND the value is more than Rs. 50,000 then the invoice should carry: i. name and address of the recipient ii. address of delivery iii. state name and state code

6. HSN code of goods or accounting code of services**

7. Description of the goods/services

8. Quantity of goods (number) and unit (metre, kg etc.)

9. Total value of supply of goods/services

10. Taxable value of supply after adjusting any discount

11. Applicable rate of GST (Rates of CGST, SGST, IGST, UTGST and cess clearly mentioned)

12. Amount of tax (With breakup of amounts of CGST, SGST, IGST, UTGST and cess)

13. Place of supply and name of destination state for inter-state sales

14. Delivery address if it is different from the place of supply

15. Whether GST is payable on reverse charge basis

16. Signature of the supplier

** HSN Code:

- Turnover less than 1.5 crores- HSN code is not required to be mentioned

- Turnover between 1.5 -5 crores can use 2-digit HSN code

- Turnover above 5 crores must use 4-digit HSN code

4. Reasons for Not Issuing a Tax Invoice

A registered person may not issue a tax invoice when:- the recipient is not a registered person AND

- the recipient does not require such invoice

What's Your Reaction?